This simple tool is the perfect one for you to start with — Porter’s Five Forces Model. It is an effective tool to evaluate the existing market. And if sometimes you are asked to analyze a market and identify its major competitors but you are struggling on where to begin; or, if you are looking to raise your company’s competitiveness in the industry, the Porter’s Five Forces Models could then be your remedy.

What exactly are the Porter’s Five Forces?

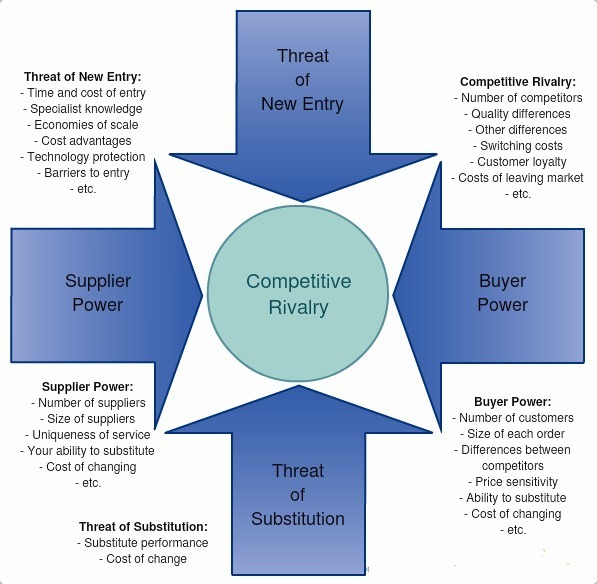

The Porter’s Five Forces Model is named after Michael E. Porter, an economist. He proposed the model in his 1979 book Competitive Strategy. While there are different names for the five forces to different experts, they are essentially the same. Generally, the five forces are as follows:

- Threat of Substitution It concerns the availability of substitutes products or services from the competitors. Porter’s definition of substitute good in the model refers to a good in another industry. The goods or services are substitutes if they can be used in place of one another. This force is affected by various factors including the cost for customers to switch to a substitute, buyer’s propensity to substitute and price-performance of substitutes.

- Threat of Established Rivals It considers the strength of the rivalry present in the current industry.There are a number of possible factors including number of competitors, pace of market growth and diversity of competition.

- Threat of New Entrants It refers to the potential threat posed by newcomers in the industry. It is also known as the barriers to entry as it measures the vitality of new entrants in an industry. Capital costs, branding of existing competitors and requirement of proprietary technology or patents are the major factors influencing the force.

- Bargaining Power of Suppliers It concerns the ease for suppliers or factor of production to raise prices. For example, the number of possible suppliers and whether they produce homogenous or differentiated products can influence the price to a great extent.

- Bargaining Power of Customers It considers the ease for customers to push for a lower price. To illustrate, it is more likely for customers to demand a lower price if they purchase a large amount of goods or services. Number of customers and brand name strength also affect the bargaining power of customers. The first three forces are from horizontal competition while the remaining are from vertical competition.

What’s good about the Porter’s Five Forces?

Every owner and stakeholder of a business has a question in common: how to maximise the profitability? By evaluating the industry using the model, we can grasp a clearer picture of the overall environment of the industry. In fact, the model can also be applied to have a better understanding of the current major competitors. Identifying their strengths and weaknesses allows us to devise a better strategy to further boost our competitiveness. We can also evaluate the potential of our business by comparing us with other competitors to see if the market has been saturated or not. On the other hand, the model tells us on what aspect we are better. Thus, we can put more effort to expand our competitive advantage in order to always stay ahead of the counterparts. Besides, after analysing the current and potential future states of the five competitive forces, we can seek to manipulate the forces in our favour. Adjusting the strategy can change the impact of competitive forces on the organization. A proper shift in direction can lead the company to a bright future.

Anything challenging about the Porter’s Five Forces?

Despite that Porter’s model may be applied to a lot of good use, it is a little too ideal to look at the industry. The model provides directions to evaluate an industry but such analysis is based on a perfect market assumption. In reality, the market is seldom if not never in such ideal conditions so it is impossible to perfectly evaluate an industry with this model. Instead, the model is only applicable to simple market structures. Morever, the model overlooks a sixth force – Complementors. Complementors refer to those who sell products and services that are best used in conjunction with a product or service from a competitor. Intel and Apple are a good example which they are in fierce competition yet there is obvious reliance of each other in the industry. Taking the sixth force in account makes the model more well-rounded. Lastly, the model also overlooks the technology component in today’s business world. As the model was proposed back in 1979, influencing power of technology was almost negligible compared to nowadays. Disregarding the technological aspect may render the whole analysis inaccurate. Hence, the factors in digitalisation or globalisation is usually added into the model now.

When’s the best time to apply the model?

When is a good time to make the best use of the Porter’s Five Forces Model? For business startups, it is unwise for entrepreneurs to start a company before exploring the profitability of a new entrants in the industry. In that case, the model can come in handy to analyse the market before putting in effort and investment. Also, the model can be a good tool for an operating businessto fine-tune its strategies for better growth. It is especially useful when the business is experiencing stagnant progress and has no clues where goes wrong. The model may provide the answer for the dissatisfaction. Here we demonstrate how the Porter’s Five Forces Model can be used to evaluate a business. Two world-renowned business, Facebook and Nike, are chosen. Example 1: Facebook The social networking market is significantly competitive and is constantly under rapid changes. Due to frequent introduction of new technologies, Facebook has to cope with the situation by continuous innovation and adaption to the ever-changing environment. Besides, the social networking market is unlike other market for its ease to enter the industry. Consequently, increased number of competitors intensifies the competition further, making the Threat of New Entrants and Established Rivals greater. Lastly, as the mobile market is emerging while the switching cost for users from computer to mobile is low, the Threat of Substitution is also great. Example 2: Nike The Threat of Established Rivalry is the major worry for Nike, as there is established as well as upcoming counterparts in the market. The low barrier to entry also poses a big threat to Nike as the large number of competitors will significantly impact the profitability. If Nike is unable to adapt to the customers’ trends, the growth can be severely impacted or even recorded in negative digits. Besides, the Bargaining Power of Customers is also worth consideration as the wholesaler can request for greater discounts for their tremendous demands. Featured photo credit: Flaticon via flaticon.com