Buying a beautiful house is probably the most important and expensive purchase you’ll ever make, so it is imperative to consider a few things before actually doing it such as figuring out the mortgage, researching the home loans available and of course effectively managing your finances before and after.

1. Decide How Your Dream House Will Be Like

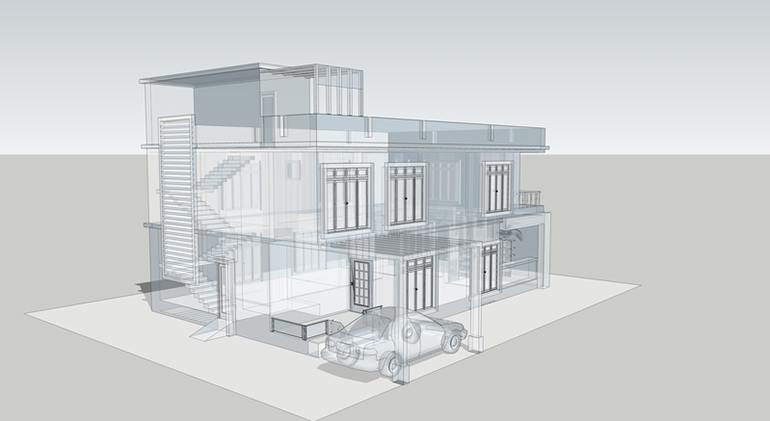

This is the time to unleash the dreamer in you. Imagine how your dream house will be like. Don’t think about the house you’d buy if you had all the money in the world but the house you really need. Work out the number of rooms depending on the number of people who will live in it, whether it’s going to be an apartment or bungalow, and the like. Check out pictures and home listings online. Also, consider the location and neighbourhood.

2. Decide Your Budget

Once you have a good idea about your needs, think about the budget and planning. How much money are you willing to shell out? If you’re looking at listings online, compare prices. Once you fix a budget, try to stay within it as you’ll have extra expenses – furniture, decoration, and maintenance costs – to consider.

3. Double Check Size, Location, Price

Now that you know exactly what you’re after, it’s time to review the facts. Check if the size of your new home is adequate not only for now but also for the future, especially if you’re planning to have children. Check if the location doesn’t make daily commuting to the office difficult and if the neighbourhood isn’t shady. And finally, the price. See if you can get it a bit cheaper. As per stats, 44% buyers found their dream home via the internet and 33% hired a realtor. We suggest you hire a realtor and go for a pre-inspection. Make sure you’re getting a good deal.

4. Fix A Deadline

Now fix a date in the future, write it down, and tape it to the fridge or wherever you’re likely to see it often. This is your goal. By this day, not only will you have purchased your dream move, but you’ll also be busy packaging items to move in. Make sure the date is realistic and that you can work towards it every day.

5. Research Home Loan Options

Perhaps the most important step of all, this is where you figure out the finances. Spend time researching the home loan options available, and choose one that seems the most flexible, saves interest costs and offers a grace period or EMI repayments. Calculate the EMI you have to pay back each month and see if you need a pay rise in your salary or another job. Do not take a risk here.

6. Work Out The Mortgage

Remember that prices of houses rise and fall. Do you have plans of selling this place in the future and moving somewhere else? Do you want to rent a part of it and make passive income? Given that 42.9% of all families have a home-secured debt (2013), it is important to not fall into the trap. There are plenty of affordable mortgage rates available – choose whether you need one with a fixed interest, adjustable rates or an interest-only loan. Consult a professional in case you are unsure before getting a mortgage pre-approval.

7. Get A Home Warranty

Nothing in this world is permanent. Earthquakes and natural disasters can happen anytime. All houses require regular repairing. Think about the future white-washing costs, plumbing leaks, rust and sediment deposition and get a home warranty that will ensure that even if something goes wrong, you don’t have to burn a hole in your pocket to replace it. To recap, before embarking on the purchase of a new home, list your requirements for your new house, make a plan, decide a budget and fix a deadline. Then research on your home loan, mortgage and warranty options and choose the one that is the best match. Go for a prior inspection and if it’s your first time, don’t hesitate to ask for professional advice and soon enough your dream home will be all yours! Featured photo credit: http://www.stockvault.net/photo/132348/beautiful-house via stockvault.net